Exploring Canadian Watercraft: Tips and Trends

Discover the latest in Canadian watercraft – from Lake Ontario fishing boats to kayaking in the Rockies.

Insurance: The Love-Hate Relationship Everyone Has

Uncover the truth about insurance: why we need it, why we dread it, and how to turn that love-hate relationship to your advantage!

Understanding the Fine Print: Why We Both Need and Loathe Insurance

Insurance is a vital component of financial planning, providing a safety net that protects us from unexpected events. It offers peace of mind, knowing that in case of disasters such as accidents, health issues, or property damage, we won't be left facing crippling financial burdens alone. Understanding the fine print of insurance policies is crucial, as it outlines what is covered and what is excluded, ensuring you know exactly what you're signing up for. Yet, this complexity often leads to confusion and frustration, as individuals grapple with intricate terminology and conditions that can leave them feeling overwhelmed.

On the flip side, many people harbor a palpable disdain for insurance companies, often viewing them as profit-driven entities that prioritize their bottom line over customer welfare. The hidden fees, complicated claims processes, and instances of denied claims can foster a sense of animosity between policyholders and providers. Thus, while we need insurance to safeguard our assets and health, our loathing often stems from the opaque practices that can leave us feeling vulnerable and misled. Balancing the necessity of protecting ourselves with the frustrations of dealing with insurance is a challenge we all face.

The Insurance Dilemma: How to Embrace Coverage Without the Stress

When it comes to navigating the world of insurance, many individuals find themselves overwhelmed by the multitude of options and the fine print involved. The insurance dilemma often arises from the fear of making the wrong choice that could lead to insufficient coverage or financial losses. To tackle this challenge effectively, it's essential to start with a thorough understanding of your needs. Begin by assessing your personal circumstances:

- Evaluate your assets.

- Consider your health needs.

- Identify potential risks.

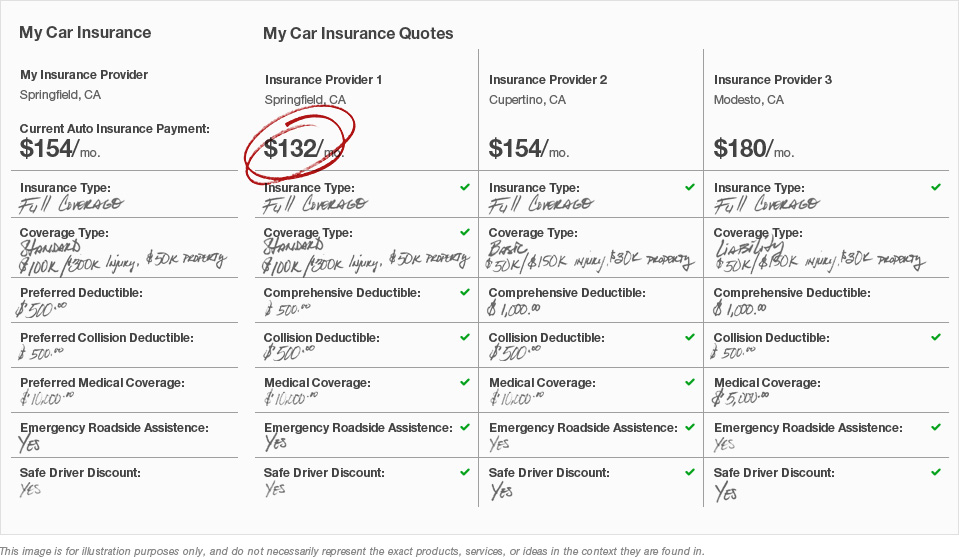

Once you've identified your coverage needs, the next step is to compare different policies and providers. This may seem daunting, but breaking it down into manageable tasks can make it less stressful. Use a comparison chart to list out key factors such as premiums, deductibles, and coverage limits. Additionally, don’t hesitate to seek advice from insurance agents or financial advisors. They can provide insights tailored to your situation, ensuring that you embrace the right coverage without succumbing to the weight of the insurance dilemma. Remember, informed decisions lead to peace of mind, allowing you to focus on what truly matters.

Is Insurance Worth It? Debunking Myths and Misconceptions

The question Is insurance worth it? often arises when individuals assess their finances and consider the necessity of various policies. Many people hold misconceptions about insurance, believing it to be a waste of money or a financial burden. However, understanding the true value of insurance can significantly alter this perspective. It serves not only as a safety net in times of crisis, but also as a tool for protecting assets and ensuring peace of mind. By debunking common myths, such as the idea that insurance is only for the wealthy or that all policies are identical, consumers can make informed decisions that could ultimately save them from unexpected financial strain.

One prevalent myth is that insurance is a scam or an unnecessary expense. While it may seem like a monthly drain on finances, insurance provides significant benefits, especially during emergencies. For instance, health insurance can cover exorbitant medical bills, while homeowners insurance can protect against property damage. Furthermore, many people underestimate the role that insurance plays in financial planning and security. By recognizing the value of being insured, individuals can shift their mindset from viewing it as merely an expense to understanding its role as a vital investment in their future well-being.