Exploring Canadian Watercraft: Tips and Trends

Discover the latest in Canadian watercraft – from Lake Ontario fishing boats to kayaking in the Rockies.

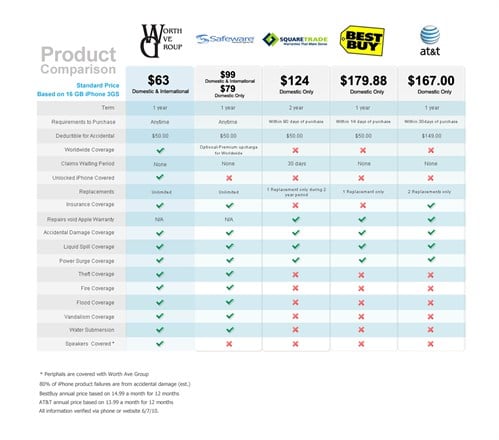

Insurance Showdown: Picking Your Perfect Policy

Uncover the secrets to choosing the best insurance policy for you! Explore our ultimate showdown and secure your peace of mind today!

Understanding the Different Types of Insurance Policies: Which One is Right for You?

When it comes to protecting your assets, understanding the different types of insurance policies available is crucial. Each policy serves a specific purpose, and selecting the right one can significantly impact your financial security. Here are some common types of insurance policies:

- Health Insurance: Covers medical expenses for illnesses, injuries, and other health-related issues.

- Auto Insurance: Provides protection against financial loss related to vehicle damage and liability from accidents.

- Homeowners Insurance: Safeguards your home and possessions from risks like fire, theft, and natural disasters.

- Life Insurance: Offers financial support to your beneficiaries in the event of your passing.

Determining which insurance policy is right for you involves evaluating your personal circumstances and needs. Consider factors such as your age, health, and financial situation. For instance, if you have a family, investing in life insurance can ensure their financial stability after you're gone. Conversely, young professionals may prioritize health insurance and auto insurance as they start their careers and manage investments. Always review the terms and coverage options of each policy before making a decision to ensure you choose the best fit for your unique situation.

The Ultimate Guide to Comparing Insurance Quotes: What to Look For

When it comes to comparing insurance quotes, understanding the key factors that influence your decision is essential. Begin by examining the coverage options offered by different insurers. Each policy may have various inclusions, exclusions, and limits. Prioritize comprehensive coverage that suits your needs while keeping an eye on the premium costs. Additionally, consider the deductibles; a higher deductible may lower your premium, but ensure that it remains affordable in case of a claim. Finally, review the customer reviews and ratings of the insurance providers to gauge their service quality and reliability.

Next, look for discounts that may apply to your policy. Many insurers offer various discounts for bundling multiple policies, safe driving records, or certain affiliations. Make a checklist of potential discounts to maximize your savings while ensuring adequate coverage. Don't forget to compare the financial stability and claims-handling reputation of each insurer, as these factors can significantly impact your experience during the claims process. By taking these steps, you can make informed choices and secure the best insurance policy that meets your needs.

Common Insurance Myths Debunked: What You Really Need to Know

When it comes to insurance, misconceptions abound that can lead to poor decision-making. One prevalent myth is that buying insurance is always a waste of money. However, the reality is that insurance serves as a financial safety net, protecting you from unexpected expenses due to accidents, health issues, or natural disasters. It's essential to view insurance as an investment in your peace of mind, rather than just another monthly bill.

Another common myth is that insurance is only necessary for older individuals or families. Many young adults believe they are invincible and can forgo coverage without consequence. In reality, unforeseen events can happen at any age; therefore, having the right insurance in place can save you from debilitating financial hardships. Remember, prevention is always better than cure, and obtaining insurance early can provide a range of long-term benefits.