Exploring Canadian Watercraft: Tips and Trends

Discover the latest in Canadian watercraft – from Lake Ontario fishing boats to kayaking in the Rockies.

Avoiding Insurance FOMO: Don’t Settle for Less

Don't fall for insurance FOMO! Discover how to choose the best coverage without compromising your needs. Get informed and save today!

Understanding Insurance FOMO: What You Need to Know

Insurance FOMO, or the fear of missing out on crucial insurance coverage, is a growing concern for many individuals navigating the complex world of insurance options. With countless policies, plans, and promotions available, it's easy to feel overwhelmed. Many consumers find themselves questioning whether they've chosen the right coverage or if they should seek out additional policies that may offer better peace of mind. This phenomenon can lead to anxiety over potential gaps in coverage or the fear of incurring unforeseen expenses due to insufficient protection.

To better understand Insurance FOMO, it’s essential to evaluate your personal and financial risks carefully. Begin by conducting a thorough risk assessment, identifying the areas where you may need coverage, such as health, property, or life insurance. Additionally, consider consulting with an insurance professional who can help demystify the options available to you. Remember, while having comprehensive insurance is important, it's equally vital to avoid purchasing unnecessary policies that may not align with your specific needs. In essence, empowering yourself with knowledge can help mitigate the fear of missing out and allow you to make informed decisions.

5 Essential Tips to Avoid Insurance FOMO

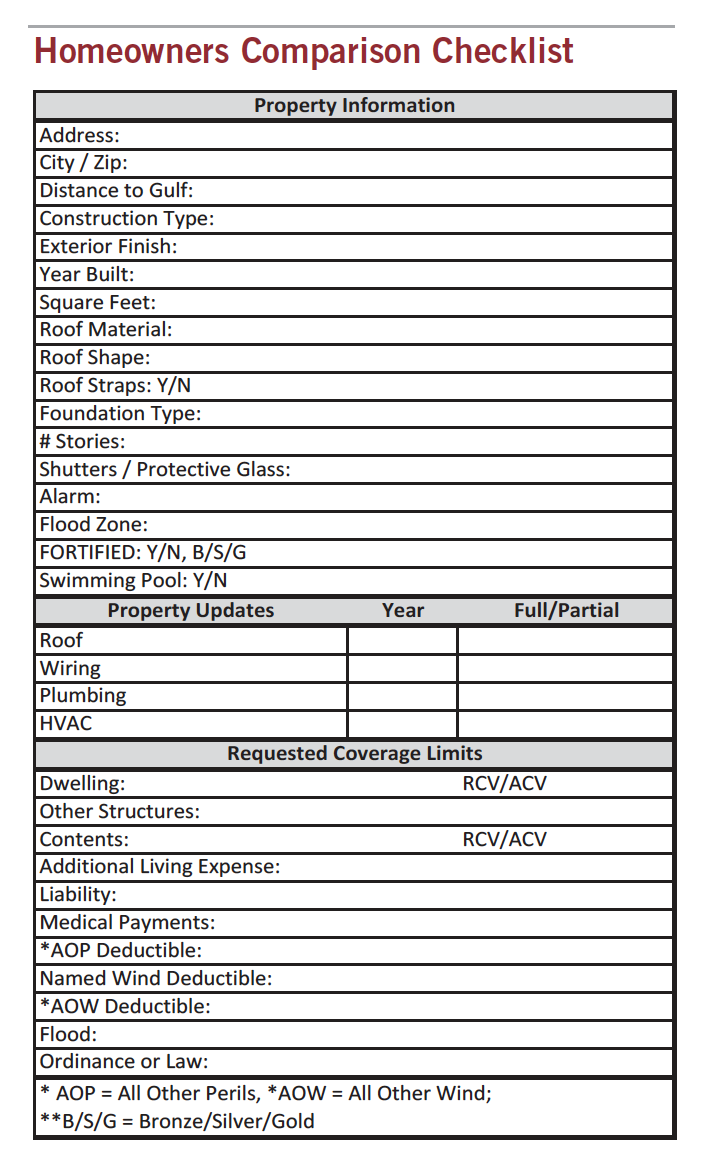

In today's fast-paced world, the fear of missing out (FOMO) can extend into various aspects of life, including insurance. To mitigate this feeling, it's crucial to educate yourself about the types of coverage available. Researching your needs can significantly reduce anxiety around your insurance options. Consider creating a checklist of essential coverages relevant to your situation, such as health, auto, and home insurance. This will not only help you in making informed decisions but also give you a sense of control over your choices.

Another vital tip is to compare quotes from different providers. FOMO often arises from the fear that you might be missing out on the best deal. By gathering multiple quotes, you can make comparisons and understand the market value for the coverage you're considering. Additionally, engaging an insurance advisor can provide personalized guidance and support, helping to alleviate concerns about possibly overlooking the best policies. Remember, having the right insurance coverage means peace of mind, not just filling a perceived gap.

Is Your Insurance Policy Good Enough? Key Questions to Ask

When evaluating whether your insurance policy is good enough, ask yourself a series of key questions that can help illuminate any gaps in coverage. Start by considering what types of coverage you currently have in place. Do you understand what is included in your policy? Review the terms, conditions, and exclusions, as policies can often contain fine print that might leave you vulnerable. Additionally, inquire about the limits of your coverage: Are you adequately covered for your current needs?

Next, assess the adequacy of your policy by considering your lifestyle and asset value changes. For instance, have your assets increased since you took out the policy? It's important to adjust your coverage to reflect these changes to avoid being underinsured. Furthermore, ask, how does your insurance policy compare with other options available? Research similar policies from other providers, keeping an eye on both price and coverage benefits. This due diligence could reveal opportunities for better protection or costs savings.