Exploring Canadian Watercraft: Tips and Trends

Discover the latest in Canadian watercraft – from Lake Ontario fishing boats to kayaking in the Rockies.

Marketplace Liquidity Models: The Secret Ingredient for Thriving Platforms

Unlock the secret to marketplace success! Discover how liquidity models can transform your platform into a thriving hub for buyers and sellers.

Understanding Marketplace Liquidity: Key Concepts and Strategies

Understanding marketplace liquidity is crucial for both buyers and sellers in any trading environment. Liquidity refers to how easily assets can be bought or sold in a marketplace without causing drastic changes in the asset's price. In a liquid market, transactions can be executed quickly and at stable prices, while in an illiquid market, trades may take longer and can lead to significant price fluctuations. Key factors influencing marketplace liquidity include the number of participants, the volume of trades, and the available information about the assets being traded. Understanding these elements is essential for making informed trading decisions and ensuring a favorable trading experience.

There are several strategies to enhance marketplace liquidity that traders can implement. Firstly, participating actively in multiple platforms can increase exposure and access to various liquidity pools. Secondly, using limit orders instead of market orders can help manage price levels better, ensuring that trades execute at desired prices. Additionally, being aware of peak trading times can lead to more favorable execution conditions, as liquidity often varies throughout the day. Lastly, utilizing automated trading systems can help maintain consistent participation in the market, further improving liquidity. By incorporating these strategies, traders can navigate the complexities of marketplace liquidity effectively.

Counter Strike is a popular multiplayer first-person shooter game where teams of terrorists and counter-terrorists compete to achieve objectives such as bomb defusal and hostage rescue. Players can enhance their gaming experience by utilizing various skins and weapons, and you can find great deals with the daddyskins promo code. The game requires teamwork, strategy, and good reflexes, making it a favorite among competitive gamers worldwide.

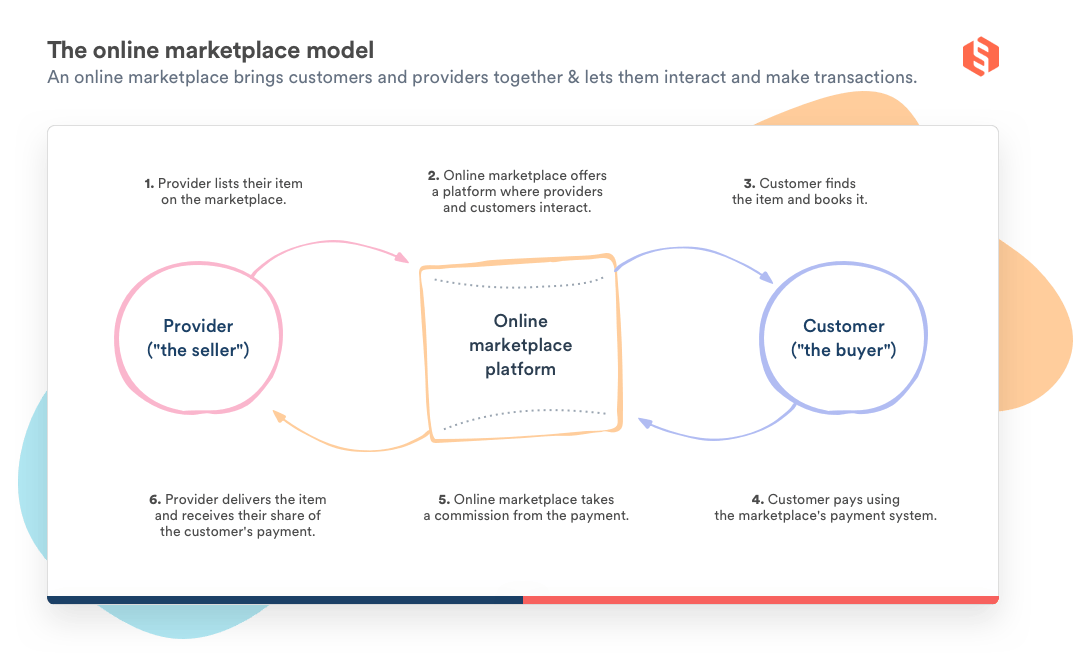

How Marketplace Liquidity Models Drive Platform Success

Marketplace liquidity models are crucial for the success of platforms that connect buyers and sellers. These models determine how easily participants can transact and the speed at which inventory can move. When a platform has high liquidity, it attracts more users, which in turn increases transaction volume. This creates a virtuous cycle: more transactions lead to better data, improved matching algorithms, and enhanced user experience. As platforms design their liquidity strategies, elements such as pricing structures, incentivization of user activity, and effective marketing play key roles in fostering a dynamic marketplace environment.

Successful platforms often utilize different types of liquidity models to cater to the needs of their user base. For instance, some may implement a market maker model that guarantees a certain level of liquidity, while others might adopt a peer-to-peer model, relying on user participation to drive transactions. Furthermore, understanding user behavior and market trends allows platforms to adapt their liquidity strategies effectively. In a fast-paced digital economy, staying agile and responsive to changes in demand and supply is essential for maintaining competitiveness and ensuring long-term platform success.

What Makes a Marketplace Thriving? The Role of Liquidity Models

A thriving marketplace is often characterized by its ability to attract and retain a diverse array of participants, from buyers to sellers. One of the crucial factors that contribute to this dynamism is the presence of effective liquidity models. These models ensure that transactions can occur seamlessly, allowing for a constant flow of goods or services. A strong liquidity model reduces the time it takes to match buyers with suitable sellers, ultimately leading to higher user satisfaction. Moreover, by providing various options for trade and facilitating quick transactions, liquidity models enhance the overall user experience, making the marketplace more appealing to both new and returning users.

In addition to enhancing user experience, liquidity models play a pivotal role in stabilizing prices within the marketplace. When participants can execute trades without significant delays or discrepancies, it helps maintain fair pricing that reflects true market demand. This stability attracts even more participants who are drawn by the confidence that they can buy or sell at predictable prices. As a result, a well-structured liquidity model not only fuels immediate transactions but also fosters long-term growth and sustainability for the marketplace, locking in its status as a competitive platform in the digital economy.